Leverage, the strategy of employing borrowed funds to initiate trading positions, holds the potential to significantly magnify both profits and losses. When navigating the crypto markets, traders have access to several leverage methods, notably margin trading, futures, and options contracts. However, this strategy is not without its risks. Traders must contend with volatility, the possibility of liquidation, interest expenses, and counterparty risk. Prioritizing risk management is imperative, as the judicious and responsible use of leverage can emerge as a powerful tool to bolster trading returns. Insight into this domain is offered by BTCC cryptocurrency questions and answers. BTCC exchange, established in 2011, stands as one of the longest-running and most reputable cryptocurrency exchanges worldwide. Its steadfast dedication to security and regulatory adherence has earned it a prominent position in the industry, making it a favored destination for numerous traders. With its reach extending to the US, Canada, and Europe, the platform is particularly tailored to cater to the needs of North American and European traders.

- What Is Leverage and How Does It Work?

- How Leverage Trading Operates Within the Cryptocurrency Market?

- How to Leverage Trade BTC: A Crypto Trading Example?

- What Are the Various Forms of Leverage Trading?

- How Can Contracts for Differences (CFDs) Optimize Trading?

- Is Margin Trading Worth the Risk?

- Crypto: What’s Next for Futures?

- Crypto Options: What Are They?

- Is Leverage Trading Actually Safe?

What Is Leverage and How Does It Work?

Leverage, a powerful tool in trading, allows traders to open positions with borrowed capital, thus amplifying both potential profits and risks. By utilizing leverage, a trader can hold a larger stake in an asset than what their personal capital permits. However, this magnification doesn’t just apply to returns; it equally enhances the possibility of losses. It’s important to note that leverage isn’t exclusive to the cryptocurrency domain; it’s a common practice in traditional financial markets, including stocks, bonds, commodities, and even real estate.

How Leverage Trading Operates Within the Cryptocurrency Market?

Leverage trading in crypto allows you to control a larger position with a smaller capital, amplifying gains when trades move favorably. For instance, with just $1,000, you can leverage a $10,000 position. If the crypto asset rises by 1{c67b73540e6dc0805e9c14a9fd40b929a88ef207d760406f3bed589ab42a8481}, profits are calculated based on the $10,000, not just your initial $1,000. However, this strategy also magnifies losses. If the trade goes against you, losses are tallied up on the full leveraged amount, not just your original investment. Therefore, while leverage can boost profits, it equally increases risk.

How to Leverage Trade BTC: A Crypto Trading Example?

Using 10x leverage, you can control a $10,000 BTC trade with just $1,000. But beware: leverage magnifies profits and losses. A mere 1{c67b73540e6dc0805e9c14a9fd40b929a88ef207d760406f3bed589ab42a8481} BTC price move can lead to a 10{c67b73540e6dc0805e9c14a9fd40b929a88ef207d760406f3bed589ab42a8481} gain or loss. While this strategy can maximize your gains, it also significantly increases your risk. So, trade carefully and be prepared for potential swings in your investment.

- Example of Crypto Leverage Trading: BTC Trade

- Initial Capital: $1,000

- Leverage: 10x (controlling a $10,000 position)

- BTC Price at Start: $60,000 per coin

- Profit Potential:

- If BTC rises 1{c67b73540e6dc0805e9c14a9fd40b929a88ef207d760406f3bed589ab42a8481} to $60,600, profit is $100 (1{c67b73540e6dc0805e9c14a9fd40b929a88ef207d760406f3bed589ab42a8481} of $10,000),

- Representing a 10{c67b73540e6dc0805e9c14a9fd40b929a88ef207d760406f3bed589ab42a8481} gain on the initial capital of $1,000.

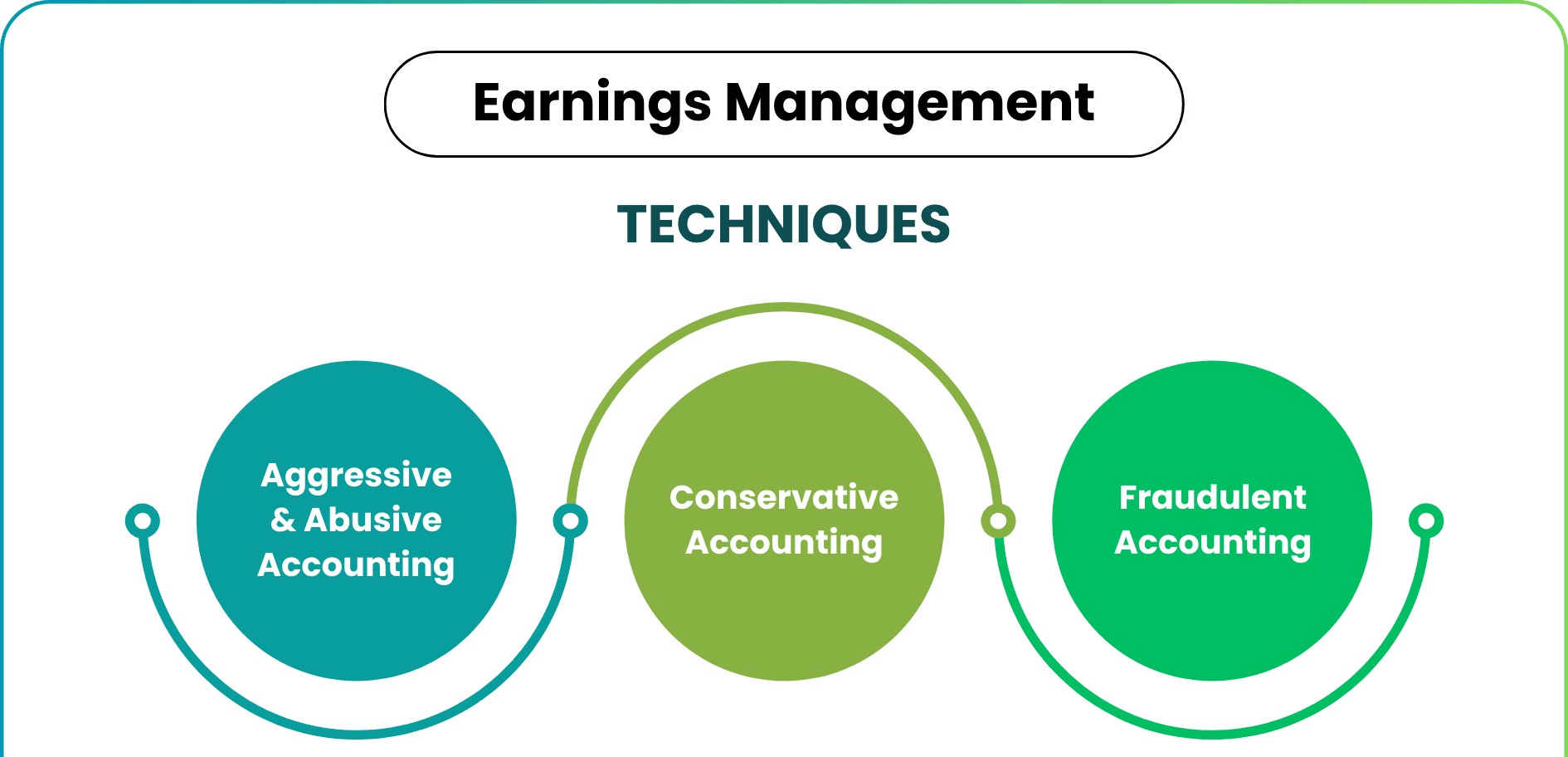

What Are the Various Forms of Leverage Trading?

Leverage trading has been integrated into crypto markets in multiple ways, each with its unique mechanism. Here’s a concise rundown on how they operate, offering investors varied strategies to amplify their trades.

How Can Contracts for Differences (CFDs) Optimize Trading?

Contracts for Differences (CFDs) enable traders to speculate on cryptocurrency price movements without owning the asset. These financial instruments involve an agreement between the trader and broker to settle the value difference between opening and closing a position. Traders can buy and sell CFDs, mimicking transactions in the underlying asset, making CFDs a versatile tool for market speculation.

Is Margin Trading Worth the Risk?

Margin trading empowers crypto traders to leverage their positions by borrowing funds directly from the exchange. By depositing a collateral, known as the margin, traders can access positions worth multiples of their initial investment. However, it’s crucial to maintain the margin requirements set by exchanges, as failure to do so may lead to forced liquidations. The final profit or loss is determined when the trader closes their position.

Crypto: What’s Next for Futures?

Crypto futures contracts enable traders to speculate on the price movements of cryptocurrencies, whether up or down, without actually owning them. By depositing collateral capital as margin, traders can amplify their positions and potentially reap greater profits through leverage. However, this also heightens the risk of forced liquidations. Daily profits or losses are settled to traders’ accounts through a ‘marking to market’ process, reflecting the fluctuations in cryptocurrency prices.

Crypto Options: What Are They?

In the crypto world, options contracts empower buyers with the choice, not the duty, to trade the base asset at a pre-agreed ‘strike’ price, anytime up to expiration. The seller bears the responsibility to honor the option if exercised. A significant leverage is attainable thanks to the small initial premium paid, in contrast to the extensive position established.

Is Leverage Trading Actually Safe?

Trading with leverage can amplify profits, but beware: it can also magnify losses. Additionally, traders must be aware of other risks involved. Carefully consider these factors before leveraging your trades.

- Volatility: Crypto markets are known for their extreme volatility, often experiencing double-digit price fluctuations. This characteristic makes leverage trading especially risky, as unfavorable price movements can lead to significant losses.

- Liquidation Risk: In leveraged trading, borrowed funds serve as collateral. If the market moves against your position and you fail to meet margin calls, the exchange may liquidate your position to offset losses.

- Interest Costs: Margin trading often incurs interest payments on borrowed funds, affecting the profitability of leveraged positions.

- Counterparty Risk: Traders using leveraged positions via exchanges or borrowing platforms face counterparty risk. Reliance on these platforms can lead to potential platform failures, hacks, or insolvencies, resulting in fund losses.

- Risk Management: Given these risks, it’s essential for traders to research and implement prudent risk management strategies such as strict position sizing, stop losses, and diversification.

- Responsible Leverage: When used wisely, leverage can be a powerful tool to boost trading returns.